In today’s fast-paced world, the insurance industry is constantly evolving, and keeping up with customer demands is no small feat. Insurance CRM solutions have emerged as vital tools in this landscape, transforming the way insurance companies interact with their clients. These tools help streamline processes, improve customer relationships, and boost overall efficiency.

Insurance companies deal with a vast amount of data daily, from customer profiles to policy details. Managing this data manually can be overwhelming and prone to errors. That’s where CRM solutions come in. They offer a centralized platform for managing customer interactions and data, ensuring that every piece of information is at your fingertips when you need it.

Moreover, the insurance sector has unique needs that standard CRMs might not address. Insurance CRM solutions are specifically designed to meet these needs, offering features like policy tracking, claims management, and compliance monitoring.

By leveraging these tools, insurance companies can focus more on building strong relationships with their clients rather than getting bogged down by administrative tasks. This shift not only enhances customer satisfaction but also drives business growth.

In the following sections, we’ll delve deeper into what makes these CRM solutions indispensable for the insurance industry and how they can be tailored to suit specific business needs. Let’s explore why adopting these solutions can be a game-changer for your insurance business.

Understanding Insurance CRM Solutions

What is a CRM?

CRM, or Customer Relationship Management, is like the digital backbone for businesses that want to keep their customers happy and engaged. In simple terms, it’s software that helps companies manage all their interactions with current and potential customers.

Think of it as a super-organized digital filing cabinet, where every email, call, purchase, and preference is neatly stored for easy access. This technology is vital for businesses aiming to streamline their operations and improve customer service.

Specific Needs of the Insurance Industry

The insurance industry has its own set of unique challenges and requirements that make a specialized CRM necessary. Insurers deal with a ton of paperwork and regulatory compliance.

A CRM for insurance must handle complex data, like policy details, claims, and customer interaction history. It should also streamline communication between agents and clients, ensuring that no detail is overlooked.

For instance, Insurance CRM software is designed to enhance efficiency and client management, which is crucial in maintaining strong customer relationships and managing prospects effectively.

Insurance CRMs also often include features like automated reminders for policy renewals, compliance management tools, and analytics to predict customer needs. These systems help agents be more proactive and less reactive, which is key in a field where customer trust and satisfaction are paramount.

Key Features of Insurance CRM Solutions

Customer Data Management

In the fast-paced world of insurance, keeping track of customer information can be a game-changer. Customer data management is all about having a centralized system where you can store and access detailed profiles of your clients. This includes everything from their info, and policy details, to even their communication history.

Having this data at your fingertips means not only can you provide a more personalized service, but you can also spot opportunities for cross-selling and upselling. Imagine being able to pull up a customer’s entire history with just a few clicks—it’s like having a crystal ball for customer insights.

Automated Workflows

Automation is the name of the game when it comes to boosting efficiency in the insurance sector. With automated workflows, routine tasks like sending out policy renewal reminders or processing claims can be handled without lifting a finger.

This not only saves time but also reduces the risk of human error. Think about it: your team can focus on more important tasks like building relationships with clients, while the CRM takes care of the mundane stuff. It’s a win-win.

Analytics and Reporting

In today’s data-driven world, being able to analyze and report on your business activities is crucial. Insurance CRM solutions come equipped with powerful analytics tools that allow you to track everything from sales performance to customer satisfaction levels.

With these insights, you can make informed decisions that drive your business forward.

Plus, you can easily share these reports with your team, so everyone is on the same page. It’s all about turning data into action.

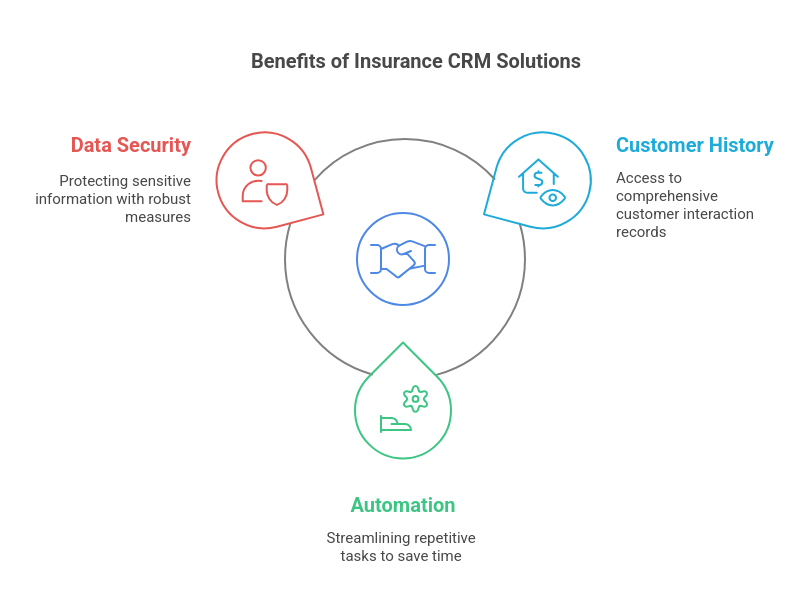

Benefits of Using Insurance CRM Solutions

Improved Customer Relationships

Insurance CRM solutions are like the secret sauce to better customer relationships. They give agents a full view of a customer’s history, from past interactions to current policies. This means when a customer calls, the agent isn’t starting from scratch.

They can pick up right where the last conversation left off, making the customer feel valued and understood. This personalized attention makes clients more likely to stick around.

Plus, with CRM, you can tailor communications based on the customer’s preferences and needs, which is a big win for customer satisfaction.

Increased Efficiency and Productivity

Let’s face it, the insurance world is full of paperwork, and it can get overwhelming. But with CRM solutions, a lot of the manual work gets automated. Think automated reminders for policy renewals or automated follow-up emails. This not only saves time but also reduces the chance of human error.

Efficiency goes through the roof as agents can focus more on building relationships and less on mundane tasks. And with everything centralized, information retrieval becomes a breeze, speeding up processes and boosting productivity.

Enhanced Data Security

In today’s digital age, data security is non-negotiable. Insurance CRM systems come equipped with top-notch security features to protect sensitive client information. They offer encryption, access controls, and regular security audits to ensure data is safe from breaches.

This means both the company and the customer can breathe easily knowing their information is secure. It’s not just about compliance; it’s about building trust with clients who rely on you to safeguard their data.

Choosing the Right Insurance CRM Solution

When it comes to selecting an insurance CRM solution, there are several factors to consider. Choosing the right CRM can make or break your agency’s efficiency and customer satisfaction. Here’s what you need to keep in mind:

Factors to Consider

- Ease of Integration: The CRM should seamlessly integrate with existing systems. This is crucial for ensuring that data flows smoothly across platforms without disrupting current operations.

- Customization Options: Every insurance agency has unique needs. A CRM that offers robust customization features allows you to tailor functionalities to suit your specific business processes.

- Security Features: Given the sensitive nature of client data, the CRM must have strong security measures in place to protect against breaches.

- User-Friendly Interface: An intuitive interface is important for quick adoption by your team. If the system is too complex, it could lead to frustration and underutilization.

- Scalability: As your business grows, your CRM should be able to scale with you, accommodating more users and larger data volumes without a hitch.

Top Providers in the Market

- Insightly: Known for its customizable features and easy integration capabilities, Insightly is a favourite among insurance agencies. It offers modules like Insightly Marketing and Service to enhance its core CRM functionalities.

- Zoho CRM: Offers a wide range of features and strong customer support, making it a reliable choice for many businesses.

- Salesforce: Renowned for its powerful automation tools and comprehensive analytics, Salesforce is a go-to for larger agencies looking to leverage data-driven insights.

Ultimately, the best CRM for your insurance agency will depend on your specific needs and goals. Take the time to evaluate different options, and don’t hesitate to request demos to see how each system performs in real-world scenarios.

Conclusion

So, there you have it. Insurance CRM solutions are shaking things up in the industry. They’re not just about keeping track of customer info anymore. These tools are helping insurance companies work smarter, not harder.

By using CRM software, agents can get a better handle on what their clients need and when they need it. This means more personalized service and happier customers. Plus, with all the data at their fingertips, companies can spot new opportunities and grow their business.

It’s clear that CRM solutions are a big deal for insurance, making things more efficient and customer-focused. If you’re in the insurance game and not using CRM, you might want to start thinking about it.

Frequently Asked Questions

What exactly is a CRM?

A CRM, or Customer Relationship Management, is a tool that helps businesses manage and analyze customer interactions and data throughout the customer lifecycle. It aims to improve customer service relationships and assist in customer retention and sales growth.

Why is CRM important for insurance companies?

CRM is important for insurance companies because it helps them manage customer data efficiently, track sales leads, automate workflows, and provide personalized customer service. This leads to improved customer satisfaction and business growth.

How do insurance CRM solutions improve customer relationships?

Insurance CRM solutions improve customer relationships by organizing customer data, enabling personalized communication, and providing insights into customer needs and behaviours. This helps insurance agents offer tailored services that meet individual customer needs.

What features should I look for in an insurance CRM solution?

Look for features like customer data management, automated workflows, analytics and reporting, compliance and documentation management, and integration capabilities with other tools you use.

Can CRM solutions help with compliance in the insurance industry?

Yes, CRM solutions can help with compliance by providing document management capabilities, ensuring that all policy documents and contracts are stored and organized properly, and helping meet regulatory requirements.

What are some top providers of insurance CRM solutions?

Some top providers of insurance CRM solutions include Insightly, Salesforce, and HubSpot, each offering various features tailored to meet the needs of insurance companies.

READ MORE:

10 Best Free WordPress Themes For Educational Websites

Top 7 GDPR Cookie Consent Plugins for WordPress